Press Release Coral Sea Cable Company Pty Ltd - December 2023

In late 2019 the Coral Sea Cable Company Pty Ltd commenced operation. To celebrate our four year anniversary we are pleased to share with our stakeholders an update on how the cable is being used and deployed. Our datasets show that in the four years of operating, the Coral Sea Cable has become critical infrastructure for PNG and Solomon Islands and is exceeding the demand forecast assumptions built into the original feasibility models.

In both markets (PNG & Solomon Islands), over the past four years of operations the Year on Year capacity consumed has increased dramatically and the effective cost per unit of capacity has fallen significantly.

The operating costs for submarine cable systems are largely fixed and rise only with inflation. Capital costs of capacity expansion tend to be very modest compared to initial deployment and are easily amortised with the additional bandwidth offered. Our outlook is therefore for continuing unit price reductions as bandwidth increases as volume dominates the economics.

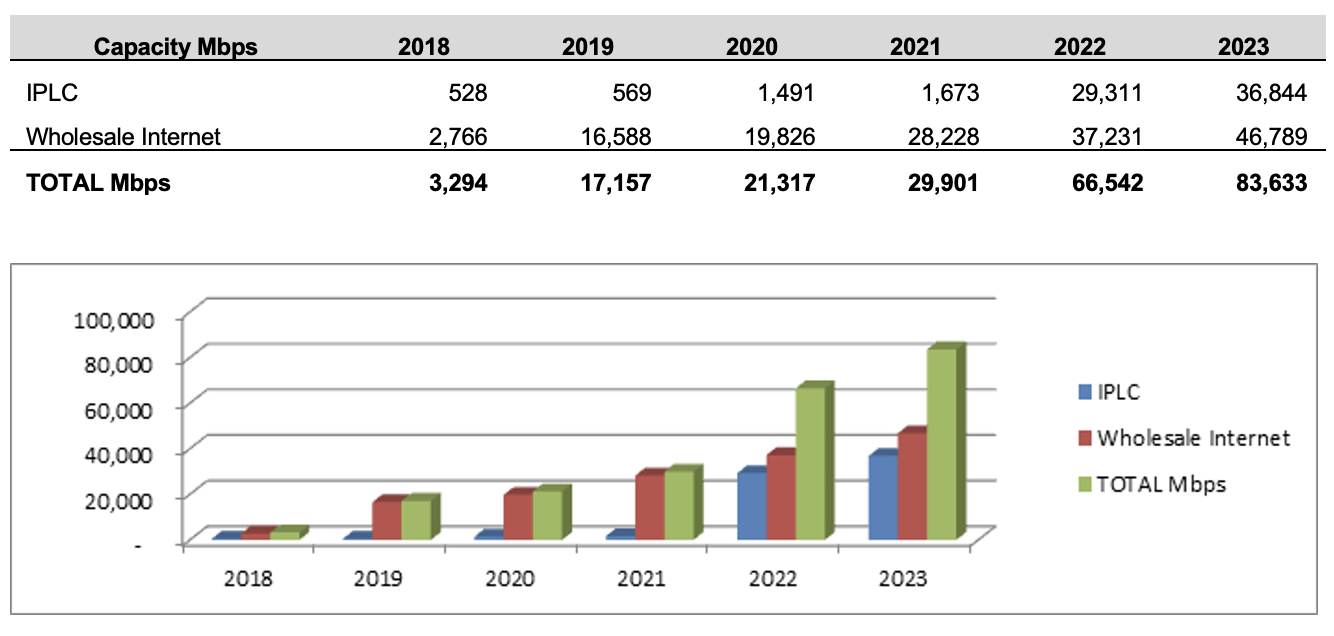

Usage and Capacity

The following shows the graphs of usage of the Coral Sea Cable:

PNG Usage 2018 to 2023

Solomon Islands Usage 2018 to 2023

Note:

These Solomon Islands figures represent the actual 95% percentile bandwidth consumed across the whole submarine cable market for Solomon Islands in the last month of each year up to 2022 and the current latest month (Oct 2023) at time of writing. There will be some additional bandwidth consumed on satellite which is not included here.

Cost Impacts

The following graphs show the decrease in wholesale bandwidth prices/costs created by the usage of the Coral Sea Cable:

PNG Costs 2018 to 2023

Prices

Solomon Islands Costs 2019 to 2023

Notes:

2019 is an estimate of average market costs of satellite services which were the only option for international bandwidth prior to CS2

The figures from 2020 onwards are year end whole market averages, taken from the total revenue of the cable company divided by overall utilisation so they represent real world year end figures experienced by SISCC customers.

Notes:

This data is sourced from the annual report of the Telecommunications Commission of Solomon Islands.

The average retail price per MB of data is the most useful benchmark of retail pricing to Solomon Islanders as it is their most common methos of accessing the internet.

The 2021 figure is taken from the draft report which has not yet been released on their website

2018 and 2019 are pre-launch of submarine cable services in Solomon Islands so based on satellite internet backhaul.

The percentage figure quoted is the reduction compared to the 2018 figure.

Combined View

The following provides a combined view of both PNG and Solomon Islands:

Summary

In summary the Coral Sea Cable is achieving (and in some cases exceeding) the initial objectives set by the key stakeholder parties, with further benefits to be realised over the coming years.

For further information please contact the Coral Sea Cable Company Executive Office via our contact page.